Buying a resale flat in India is a smart investment, but it comes with legal complexities. Unlike a new property, a resale flat requires thorough document verification to ensure a smooth transaction. Overlooking essential paperwork can lead to ownership disputes, financial burdens, or legal troubles. That’s why having a property document checklist is crucial. This guide will walk you through the key documents you need before making a purchase.

Why Is a Property Document Checklist Important for a Resale Flat Purchase?

Purchasing a resale flat involves multiple legal aspects, and missing any document can create complications. A property document checklist helps in:

- Ensuring the seller has legal ownership of the property.

- Verifying that there are no pending loans, disputes, or encumbrances.

- Avoiding legal troubles in the future.

Now, let’s explore the essential documents in the property document checklist that every buyer should verify.

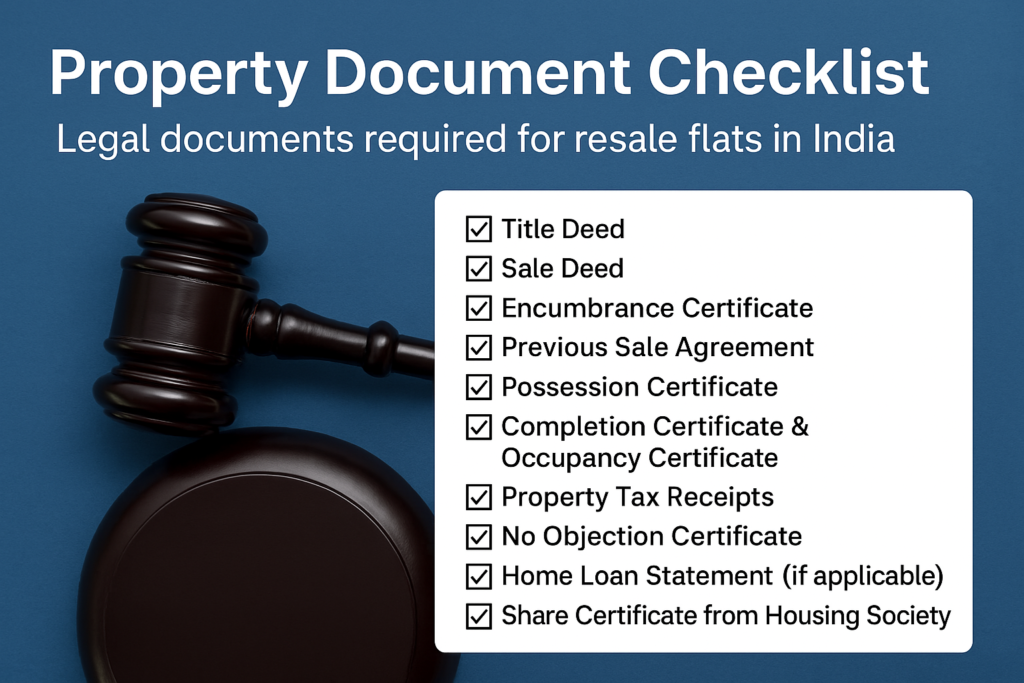

Essential Property Document Checklist for a Resale Flat

1. Title Deed – Proof of Ownership | Property Document Checklist

The title deed confirms that the seller legally owns the property. Ensure:

- The title is clear and marketable.

- The document is verified with the Sub-Registrar’s Office.

2. Sale Deed – The Most Crucial Document | Property Document Checklist

The sale deed is legal proof of property ownership transfer. It must be:

- Registered at the Sub-Registrar’s Office.

- Verified for accuracy before signing.

3. Encumbrance Certificate (EC) – Checking for Legal Claims

An Encumbrance Certificate ensures that the property is free from any financial liabilities. Obtain it from the local Sub-Registrar’s Office.

4. Agreement of Previous Sale – Ownership History

This document provides records of past ownerships. Checking it helps confirm there are no hidden claims or disputes.

5. Possession Certificate – Ensuring Physical Possession

A Possession Certificate verifies that the previous owner has handed over the property legally.

6. Completion Certificate (CC) & Occupancy Certificate (OC) – Compliance Verification

- The Completion Certificate confirms the building was constructed per regulations.

- The Occupancy Certificate proves that the property is legally fit for residence.

7. Property Tax Receipts – Avoiding Tax Liabilities

Ensure the property’s tax payments are up to date by checking recent property tax receipts.

8. No Objection Certificate (NOC) – Approval from Authorities

Issued by the builder or housing society, the NOC confirms that they have no objections to the sale.

9. Loan Clearance Certificate – Ensuring No Financial Liabilities

If the seller had taken a home loan, ensure they provide a loan closure certificate from the bank.

10. Share Certificate – Proof of Society Membership

For cooperative housing societies, this certificate verifies that the seller is a recognized member.

Steps to Verify the Property Document Checklist

After gathering the documents, here’s how to verify them:

- Consult a property lawyer to ensure all documents are legally valid.

- Visit the Sub-Registrar’s Office to check ownership history and encumbrance status.

- Check with the housing society to confirm the seller has cleared all dues.

- Verify municipal approvals to ensure legal compliance.

Conclusion:

Buying a resale flat in India is a significant investment, and verifying documents is a key step in securing your property. A well-prepared property document protects you from legal risks, financial issues, and ownership disputes. Always double-check with professionals before finalizing the deal.

Are you planning to buy a resale flat? Follow this property document checklist to make a safe and informed purchase!

If you have any questions, drop them in the comments below!

Join The Discussion